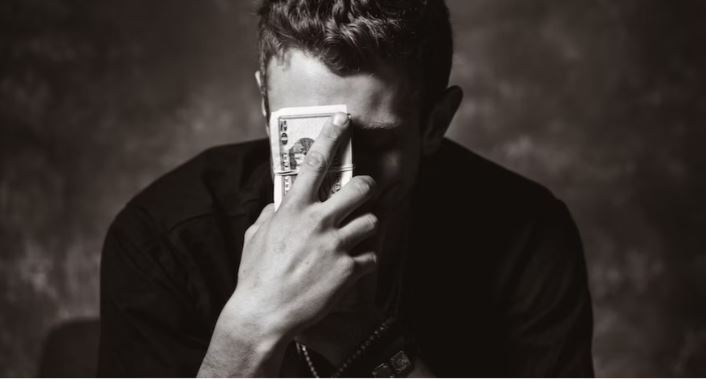

The relationship between financial well-being and mental health is profound and bidirectional, impacting individuals in various ways. Financial stress can contribute to mental health issues such as anxiety and depression, while mental health challenges can lead to financial difficulties through reduced earning capacity or increased healthcare expenses.

Acknowledging the Interconnection

Recognizing the interplay between money and mental health is pivotal in enhancing overall well-being. If financial stress weighs heavily on your mind, know that seeking assistance is a proactive step. Consulting with a financial advisor can provide guidance on budgeting, debt management, and long-term financial planning, offering a path toward reducing stress and gaining a sense of financial control.

Prioritizing Mental Health

Simultaneously, prioritizing your mental health is crucial. Engaging in regular physical activity, maintaining a balanced diet, ensuring adequate sleep, and practicing mindfulness techniques such as meditation can bolster mental well-being. If you’re grappling with mental health challenges, don’t hesitate to reach out to mental health professionals for support and guidance.

Integrating Practices for Well-being

Integrating practices that nurture both financial and mental health can lead to sustained well-being. Establishing regular financial check-ins allows for proactive management of finances, preventing issues from escalating. Techniques like mindful spending promote conscientious financial decisions aligned with personal values and goals, fostering financial stability and peace of mind.

Navigating Challenges

During periods of mental health vulnerability, it’s important to recognize its potential impact on financial decision-making. Avoid making significant financial choices during these times whenever feasible, and lean on trusted individuals or professionals for support and guidance.

Conclusion

The interconnection between money and mental health is multifaceted and individualized. By acknowledging and addressing this relationship, individuals can work toward enhancing both their financial and mental well-being. Through proactive financial management, prioritization of mental health, and the adoption of supportive practices, individuals can foster resilience and achieve a balanced approach to life’s challenges. Recognize the importance of seeking help when needed, both financially and emotionally, to pave the way toward a healthier and more fulfilling future.