Is it Wise for High School and College Students to Have Credit Cards?

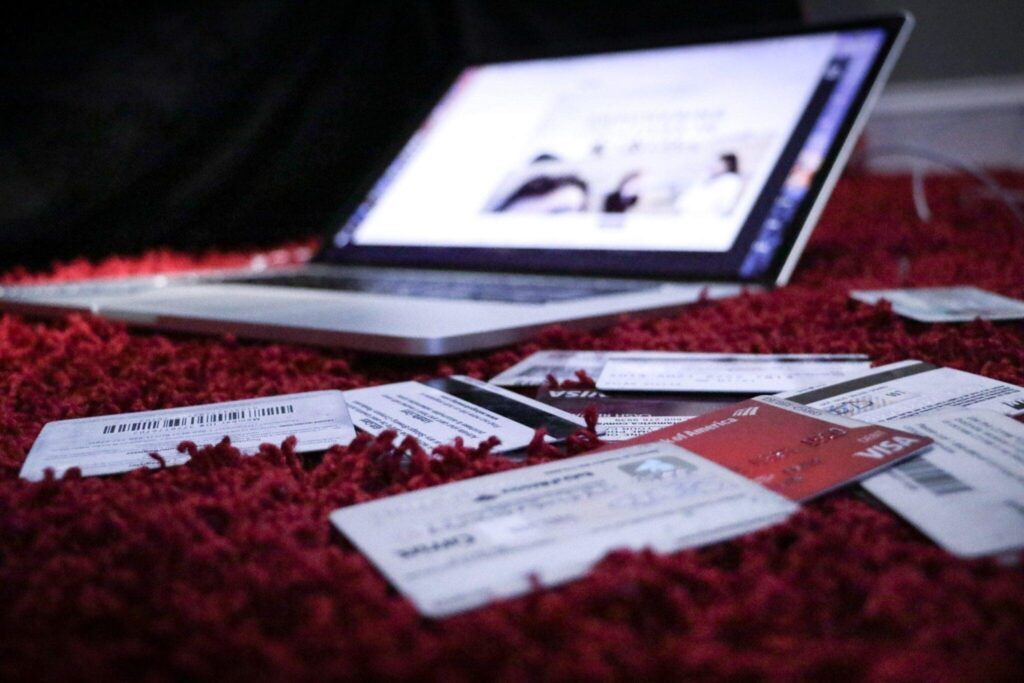

Credit card debt is a significant issue in the U.S., and many individuals struggle with it throughout their lives. Young adults, particularly high school and college students, may face unique challenges when it comes to managing credit. Whether or not students should have credit cards is a question that involves weighing the potential benefits against […]

Is it Wise for High School and College Students to Have Credit Cards? Read More »