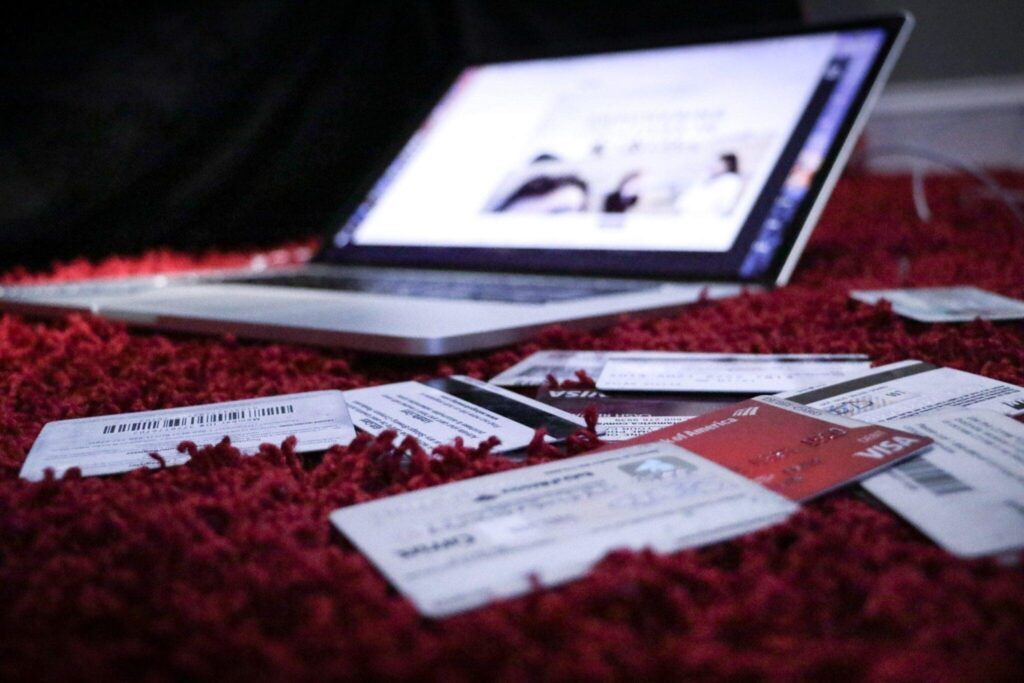

With numerous credit card offers enticing you with rewards, discounts, and benefits, it’s tempting to accumulate multiple cards. However, determining the optimal number of credit cards to have isn’t a one-size-fits-all answer. Here’s what you need to consider to find the right balance for your financial situation.

Factors to Consider

- Credit Utilization Ratio

- Definition: Your credit utilization ratio is the percentage of your total credit limit that you’re currently using.

- Impact: A lower ratio is better for your credit score. Having multiple credit cards with high limits can help keep your utilization ratio low, provided you manage them responsibly.

- Credit Score Impact

- Positive Effects: A higher number of credit cards can potentially improve your credit score by increasing your available credit and reducing your credit utilization ratio.

- Negative Effects: Opening too many cards in a short period can lower your credit score due to the hard inquiries and a reduced average account age.

- Fees and Annual Costs

- Considerations: Some credit cards come with annual fees or other costs. Weigh these expenses against the benefits of the card to determine if it’s worth keeping.

- Rewards and Benefits

- Maximizing Rewards: Having multiple cards can allow you to maximize rewards and benefits, such as cash back, travel perks, and discounts.

- Management: Ensure you’re using the cards strategically to take full advantage of their rewards without overcomplicating your financial management.

- Credit Management

- Ease of Management: More cards mean more accounts to monitor, making it crucial to stay organized and on top of payments to avoid missed due dates and interest charges.

- Automation: Utilize automatic payments and alerts to manage multiple cards efficiently.

- Credit History and Age

- Long-Term Benefits: Keeping older cards open can positively impact your credit history and average account age, which are beneficial for your credit score.

Recommended Practices

- Start Small: If you’re new to credit, begin with one or two cards to build a solid credit history. Once you have a good understanding of credit management, you can consider adding more if needed.

- Monitor Your Accounts: Regularly review your credit card statements and credit report to track spending, check for errors, and ensure your credit score remains healthy.

- Evaluate Your Needs: Consider your spending habits and financial goals when deciding how many cards to have. For example, if you travel frequently, a travel rewards card might be beneficial.

- Avoid Unnecessary Cards: Only apply for cards that offer significant benefits or serve a specific purpose. Avoid accumulating cards just for the sake of having more.

Conclusion

There’s no universally correct number of credit cards to have; it depends on your personal financial situation and management skills. Generally, having a few well-managed cards can be beneficial for your credit score and financial flexibility. Focus on responsible use, avoid excessive applications, and ensure each card serves a purpose in your financial strategy.